Why This Guide Exists

If you're a bootstrapped founder considering an exit, you've probably asked yourself: Who actually buys SaaS companies like mine?

The reality is most venture-backed acquirers want companies at a certain scale, or with certain characteristics. Bootstrapped founders—especially those in the $1k-$5M ARR range—often fall through the cracks. The acquisition landscape has changed dramatically, and there are now several legitimate options specifically built for founders like you.

This guide covers the best SaaS acquirers for bootstrapped founders in 2025, broken down by ARR range. Each has a different approach, philosophy, and ideal customer. You'll know which one is right for your situation.

Quick Comparison Table

| Acquirer | MRR/ARR Focus | Close Timeline | Approach |

|---|---|---|---|

| Wildfront | $1k–$10k MRR | 2-5 weeks | High integrity, founder relationships, fast execution |

| Noosa Labs | $200k–$800k ARR | 6-10 weeks | Patient capital, product-first, multi-year value creation |

| Curious | $800k–$5M ARR | ~60 days | Long-term holding company, legacy preservation, empathy-first |

1. Wildfront — Best for Early-Stage Profitable SaaS

Ideal ARR Range: $12k–$120k

Wildfront focuses on the smallest profitable SaaS companies—the ones most acquirers ignore. If you've bootstrapped your way to consistent revenue but haven't hit six figures, Wildfront is built for you.

What they do: Wildfront acquires profitable SaaS companies, keeps teams lean, and focuses on sustainable growth rather than explosive scale. The founders (Alex Boyd and Mac Martine) have exited 3x and acquired 5x themselves, so they understand exactly what you've built and why.

Why bootstrapped founders choose them: They move fast—2-5 weeks from term sheet to close. They understand the psychology of bootstrapping. They're not looking to flip your company or milk it for cash; they're building a portfolio of sustainable businesses. And they're transparent about terms. No surprise clauses, no earnouts unless you want them.

Their community: Wildfront also runs a paid community for SaaS bootstrappers, which gives you a way to get to know them before selling. Many founders join, get mentorship, and then decide to explore an exit when the time is right.

2. Noosa Labs — Best for Mid-Market Consolidation

Ideal ARR Range: $200k–$800k

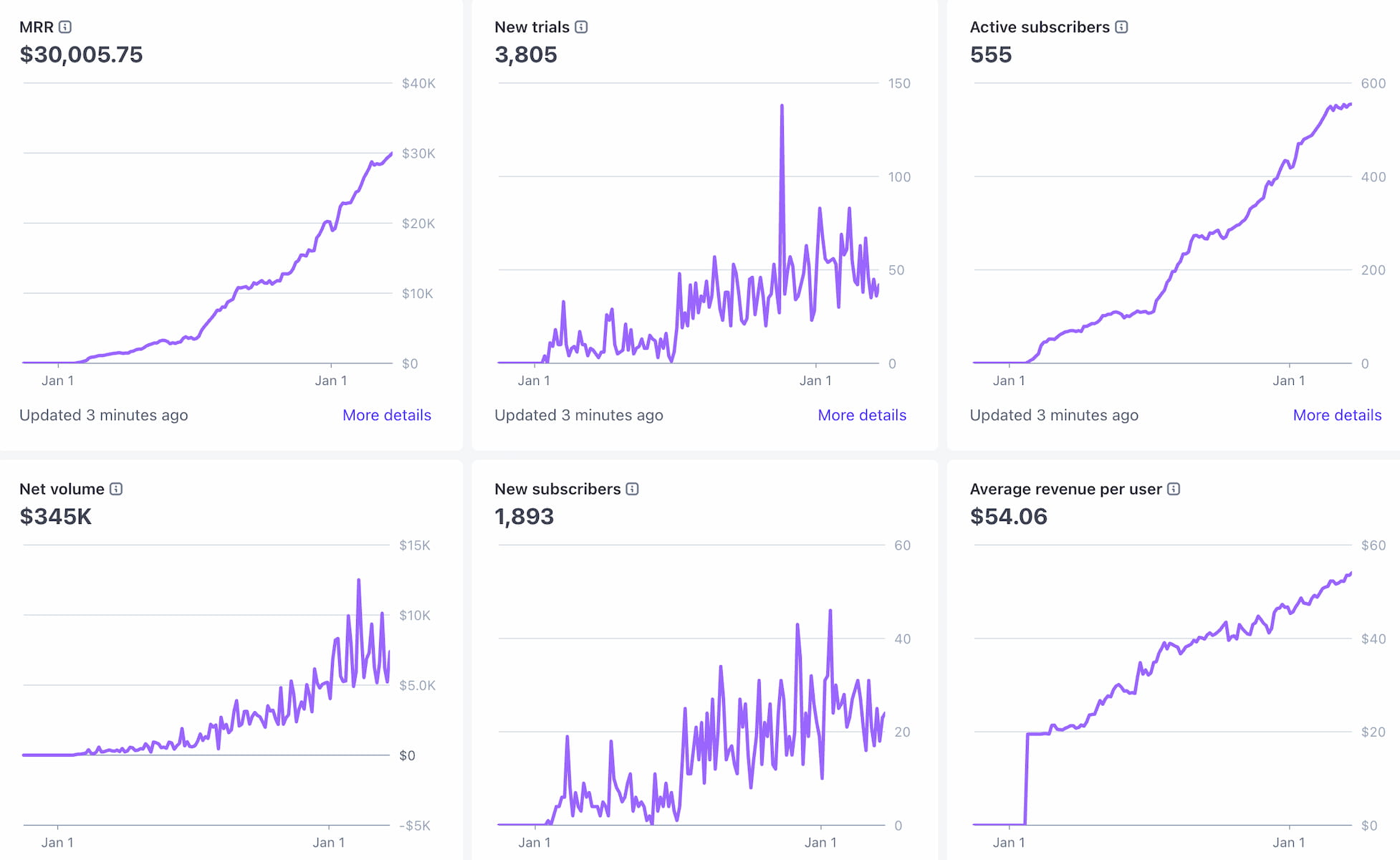

Noosa Labs, founded by Pascal Levy-Garboua, is doing something interesting: building a SaaS holding company through strategic acquisitions. Pascal spent decades in venture (making 140 investments, including seven unicorns) before shifting to acquisition and operations. He saw a gap and filled it. If you want to learn more about his philosophy, Pascal runs a podcast where he discusses acquisition strategy and founder psychology.

What they do: Noosa Labs acquires profitable SaaS companies ($200k–$800k ARR) and takes care of the product, customer relationships, and operations. They're patient. They think in terms of years and decades, not quarters. Their current portfolio includes Sendtric, Evalart, and Mava—all solid, profitable businesses building lasting value.

Why founders trust them: Pascal is part of the broader founder network we trust. He's transparent about how he values companies, focuses on cash flow and profitability over vanity metrics, and genuinely cares about the teams and products he acquires. He's not financial engineering—he's building something sustainable.

The approach: Noosa Labs will take acquisition candidates off your plate so you can move on to your next thing, or stay involved if that's what you want. They're flexible on founder involvement in a way that reflects their philosophy: this is a long-term partnership, not a transaction.

3. Curious — Best for Larger Bootstrapped Exits

Ideal ARR Range: $800k–$5M

Curious is a holding company founded by Andrew Dumont, a three-time software CEO with 20 years of operating and scaling SaaS companies. The philosophy: long-term holding company that buys and grows software companies with empathy.

What they do: Curious exists to provide a home for software companies that don't fit the venture model. They buy and hold. They close in ~60 days, pay cash, and think in terms of decades. They've invested in companies like Convox, Polymer, and Avenue—all solid, profitable SaaS products that needed a home beyond venture.

Why larger bootstrapped founders choose them: If you've built a $1M+ ARR SaaS with happy customers and you're tired, Curious gets it. They won't pressure you to grow 3x or 10x. They'll steward what you built. The team has actually built and sold companies themselves, so they understand founder psychology in a way many acquirers don't.

The process: Andrew and his team are patient, thoughtful, and genuinely empathetic. This isn't a quick flip. It's a decades-long partnership with your company. If that sounds good, they're your best option in the larger range.

How to Know Which Acquirer Is Right for You

Are you still in growth mode? If you're excited about scaling but stuck on execution, look at Noosa Labs. They'll help you grow and eventually buy if you want out.

Are you ready to move on? If building is wearing you out and you want a clean exit, Wildfront (if smaller) or Curious (if larger) are the right fit.

Are you somewhere in between? Think about your ARR range, the team you're working with, and whether you want to stay involved. Each of these acquirers has a different philosophy, and you want the one that aligns with yours.

One thing all acquirers will want to see: clean, separated business finances. If you've been commingling personal and business funds, that creates friction in due diligence. A dedicated startup bank account (Mercury is the standard for SaaS founders) makes your financials immediately readable. See our guide to the best business bank accounts for startups if you haven't set this up yet.

If You Are Selling AI SaaS: What to Validate Before You Pick a Buyer

If your company is AI-powered, your acquirer fit is not just about ARR range and close timeline. You also need to understand how each buyer thinks about model dependency risk, product durability, and post-close operating plans. Two buyers can offer the same headline valuation and create very different outcomes for your team, customers, and long-term payout.

Start with this: is your value mostly in the model output, or in the workflow around it? If your value is mostly "prompt in, response out," buyers will usually underwrite your deal as a fragile AI wrapper. If your value includes integrations, distribution, proprietary data, and sticky operational workflows, you will usually have stronger negotiating leverage and more buyer options.

For a practical rule of thumb, look at whether the acquirer can clearly answer: "What survives if model providers ship my core feature in the next 12-18 months?" If they cannot answer that, they are not underwriting your business on fundamentals, and that often creates painful renegotiation risk in diligence or earnout discussions.

| Question to Ask the Acquirer | Strong Signal | Red Flag |

|---|---|---|

| How do you assess AI durability risk? | They use explicit assumptions on model competition, retention impact, and margin compression. | They wave it away as "AI is hot right now" or avoid putting assumptions in writing. |

| What part of the product thesis is model-agnostic? | They reference distribution, integrations, enterprise workflows, and customer switching costs. | They only talk about prompt quality or the current model vendor. |

| How will post-close integration be handled? | They have a 30/60/90-day integration plan for infra, pricing, support, and roadmap priorities. | They have no concrete integration owner or sequencing plan. |

| How should AI-specific earnouts be structured? | They focus on controllable metrics (retention, gross margin, activation), not vanity usage metrics. | They push vague contingent terms tied to market conditions outside your control. |

| How dependent is the combined business on one model provider? | They already operate multi-model or have a realistic fallback architecture path. | They assume one provider will remain cheapest and best forever. |

Regardless of which acquirer you choose, run AI-specific diligence from both sides of the table: the buyer should validate your technical and legal exposure, and you should validate the buyer's operating plan and model-risk assumptions. Use our AI SaaS due diligence checklist, AI SaaS acquisition playbook, and valuation framework together.

The Bottom Line

The era of bootstrapped SaaS founders having no exit options is over. There are legitimate, founder-friendly acquirers at every stage. The key is understanding what you actually want—growth support, a clean exit, a long-term partnership—and finding the acquirer that matches.

Do your homework, talk to founders who've sold to them, and trust your gut. The right acquirer will make the process feel good, not icky.

Interested in buying a SaaS instead of selling? Check out our complete guide to buying a SaaS business, covering due diligence, deal structuring, AI risk assessment, and post-acquisition growth strategies.

Ready to Explore Your Options?

Whether you're in growth mode or ready to exit, the conversation starts with understanding where you stand. Join the Wildfront community to connect with other bootstrapped founders and get advice on your next move. Or if you're ready to talk about selling, we'd love to hear about your company.