Best Business Bank Accounts for LLCs in 2026: Mercury, Ramp & Rho

Compare the best business bank accounts for your LLC. Zero fees, fast setup, modern integrations.

You just filed your LLC. Congrats! Now you need a business bank account, and the traditional options want to charge you $25/month for the privilege of holding your money. Meanwhile, Mercury, Ramp, and Rho will pay you up to $500 just to open an account—and charge $0 in monthly fees.

The best banks for business accounts for LLCs aren't the ones your parents used. Chase and Bank of America made sense in 2010. In 2026, fintech banks offer better features, zero fees, and actually integrate with the tools you use daily. This guide covers everything you need to know about choosing the right business bank for your LLC.

Quick note: Most states require LLCs to maintain separate business accounts. Don't commingle personal and business funds—it pierces your corporate veil and eliminates your liability protection.

Quick Comparison: Best Business Bank Accounts for LLCs

| Bank | Monthly Fee | Sign-Up Bonus | Cashback | Setup Time |

|---|---|---|---|---|

Mercury

Mercury

|

$0 | $250 | 1.5% cash back Mercury IO Card (eligible companies) | 10 min |

Ramp

Ramp

|

$0 | $250 | 1.5% avg | 15 min |

|

|

$0 | $500 | Up to 2% Daily terms; 1% on monthly terms (min $75k balance) | 1-2 days |

|

|

$0 | 1%–1.5% Relay Visa Credit Card: 1% (Starter), 1.25% (Grow), 1.5% (Scale) | 1%–2% Novo Business Credit Card: 2% with $5k+ balance, 1% otherwise | 10 min |

|

|

$0 | Varies | None | 10 min |

Brex

Brex

|

$0 | Points | 1-7x pts | 1 day |

What to Look for in an LLC Business Bank Account

Fee Structure (or Lack Thereof)

The first rule: avoid monthly maintenance fees. Traditional banks charge $15-40/month for features that fintech banks offer free. That's $180-480/year you're paying for identical (often worse) service.

Watch out for:

| Fee Type | Why It Matters |

|---|---|

| Monthly maintenance fees | $15-40/month for basic checking features |

| Transaction limits | Caps at 50-100 transactions/month |

| Wire transfer fees | Charges on incoming and outgoing wires |

| Cash deposit fees | Costly for cash-heavy businesses |

| Minimum balance requirements | Forces idle cash to avoid fees |

The banks we recommend below charge $0/month with no minimums. Traditional banks can't compete.

Setup Requirements & Speed

Opening a business bank account for your LLC requires:

| Document | Notes |

|---|---|

| EIN | Employer Identification Number from the IRS |

| Articles of Organization | Your LLC formation documents |

| Operating Agreement | Some banks require this |

| Government-issued ID | Driver's license or passport |

Fintech banks approve accounts in minutes. Traditional banks take 1-2 weeks and often require in-person visits.

Modern Features That Actually Matter

Your business bank should integrate with your workflow, not create extra work.

Critical integrations:

| Integration Type | Why It Matters |

|---|---|

| Payment processors | Accept payments via Stripe, Square, PayPal |

| Accounting software | Auto-sync books in QuickBooks, Xero, FreshBooks |

| Payroll providers | Run payroll via Gusto, Justworks, Rippling |

| Expense management tools | Manage cards, approvals, receipts |

Useful features:

| Feature | Why It Helps |

|---|---|

| Multi-user access | Set permissions for teammates |

| Virtual debit cards | Create unlimited cards for different expenses |

| API access | Automate workflows and reporting |

| Expense categorization | Reduce manual bookkeeping |

| Invoice management | Track payables in one place |

Cash Back & Sign-Up Bonuses

This is where fintech banks really shine. Instead of charging you fees, they pay you:

| Bank | Sign-Up Bonus | Notes |

|---|---|---|

| Mercury | $250 | Bonus via referral link |

| Ramp | $250 | Cash back available on card spend |

| Rho | $500 | Cash back varies by terms |

Traditional banks charge you $25/month and offer nothing in return. The math isn't close.

FDIC Insurance & Safety

"But are fintech banks safe?"

Yes. Fintech banks partner with FDIC-insured institutions. Your money is protected up to $250k per account (some offer extended coverage up to $6M through multiple partner banks).

Mercury partners with Choice Financial and Evolve Bank & Trust. Ramp partners with Customers Bank. Rho partners with Webster Bank. All FDIC-insured.

Best Business Bank Accounts for LLCs (Detailed Reviews)

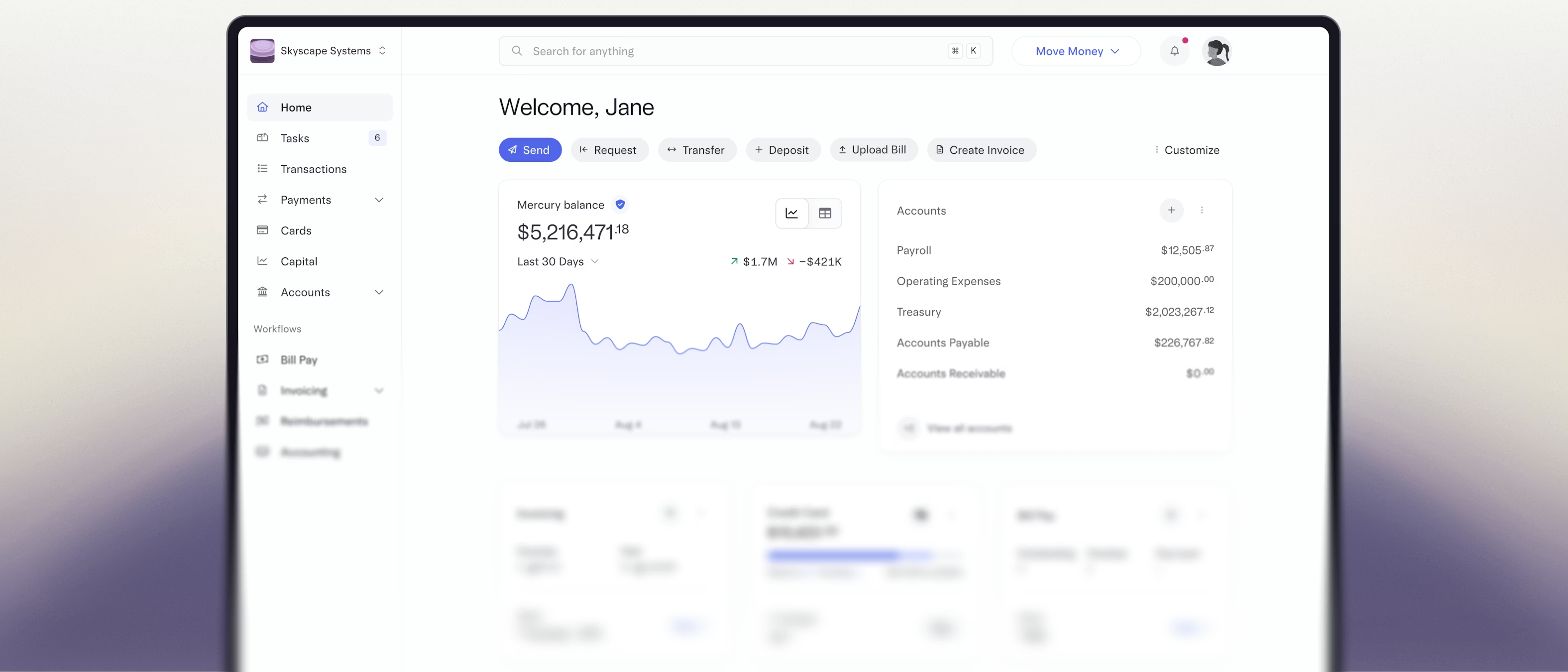

Mercury - Best Overall for Tech & SaaS LLCs

Mercury is what happens when founders build a bank for founders. No branch visits, no $25 monthly fees, just clean banking that actually integrates with your workflow. If you're a tech startup or SaaS company, this is probably the right choice.

| Metric | Details |

|---|---|

| Monthly Fee | $0 |

| Sign-Up Bonus | $250 (via referral link) |

| Setup Time | ~10 minutes |

| Best For | Tech startups, SaaS, VC-backed companies |

| Top Integrations | Stripe, QuickBooks, Gusto, Rippling |

| FDIC Insurance | Up to $5M through partner banks |

Why Mercury Works

The UI is genuinely enjoyable to use—a rare statement about banking. You can set up your account in under 10 minutes, get instant debit cards, and start accepting payments the same day. The investor update tools are built specifically for startups raising capital.

Mercury Treasury lets you earn competitive yields (4-5%+) on idle cash. Free domestic wires up to limits. Virtual cards for team expenses. Everything you'd expect from modern banking, with none of the friction from legacy systems.

The trade-off? Mercury is picky about industries. They don't work with crypto exchanges, cannabis businesses, or some other high-risk categories. And there are no physical branches (which most tech founders don't need anyway).

Bottom Line: If you're building a tech startup or SaaS company, Mercury is the default choice. Clean banking with the integrations you need and zero fees.

Get Mercury - $250 BonusRamp - Best for Expense Management & Rewards

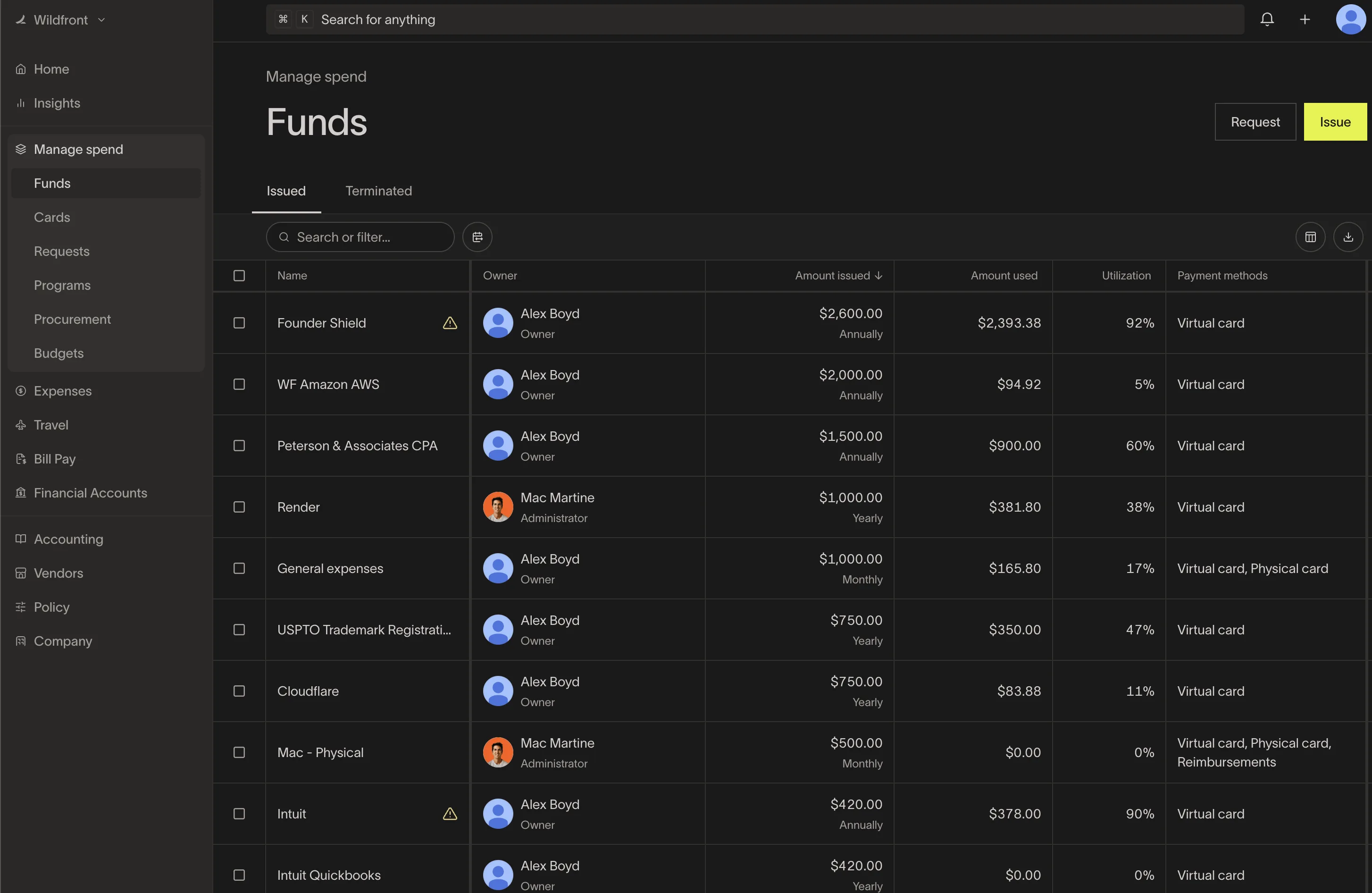

Ramp combines corporate cards, expense management, and business banking into one platform. If you have a team making purchases or want to automate your expense reports, Ramp is worth serious consideration. The 1.5% cashback doesn't hurt either.

| Metric | Details |

|---|---|

| Monthly Fee | $0 |

| Sign-Up Bonus | $250 |

| Cashback | 1.5% average on card spend |

| Setup Time | ~15 minutes |

| Best For | Teams, expense management, high spend |

| Top Integrations | NetSuite, Sage, Xero, QuickBooks |

| FDIC Insurance | Up to $250k (Customers Bank) |

Why Ramp Works

Think of Ramp as your CFO's best friend. Every purchase automatically matches receipts. Spending controls let you set limits per employee or card. Bill pay automation saves hours every month. And you earn 1.5% cashback on everything.

The accounting software integrations are exceptional—NetSuite, Sage Intacct, Xero, QuickBooks all sync in real-time. If you're tired of manually categorizing expenses or chasing down receipts, Ramp fixes that.

Real Example: If your LLC spends $10,000/month on expenses, you'll earn $150/month = $1,800/year in cashback + $250 sign-up bonus. That's $2,050 in year one versus $0 from traditional banks.

Bottom Line: Best choice for LLCs with teams, significant expenses, or anyone who wants to automate spend management while earning cashback.

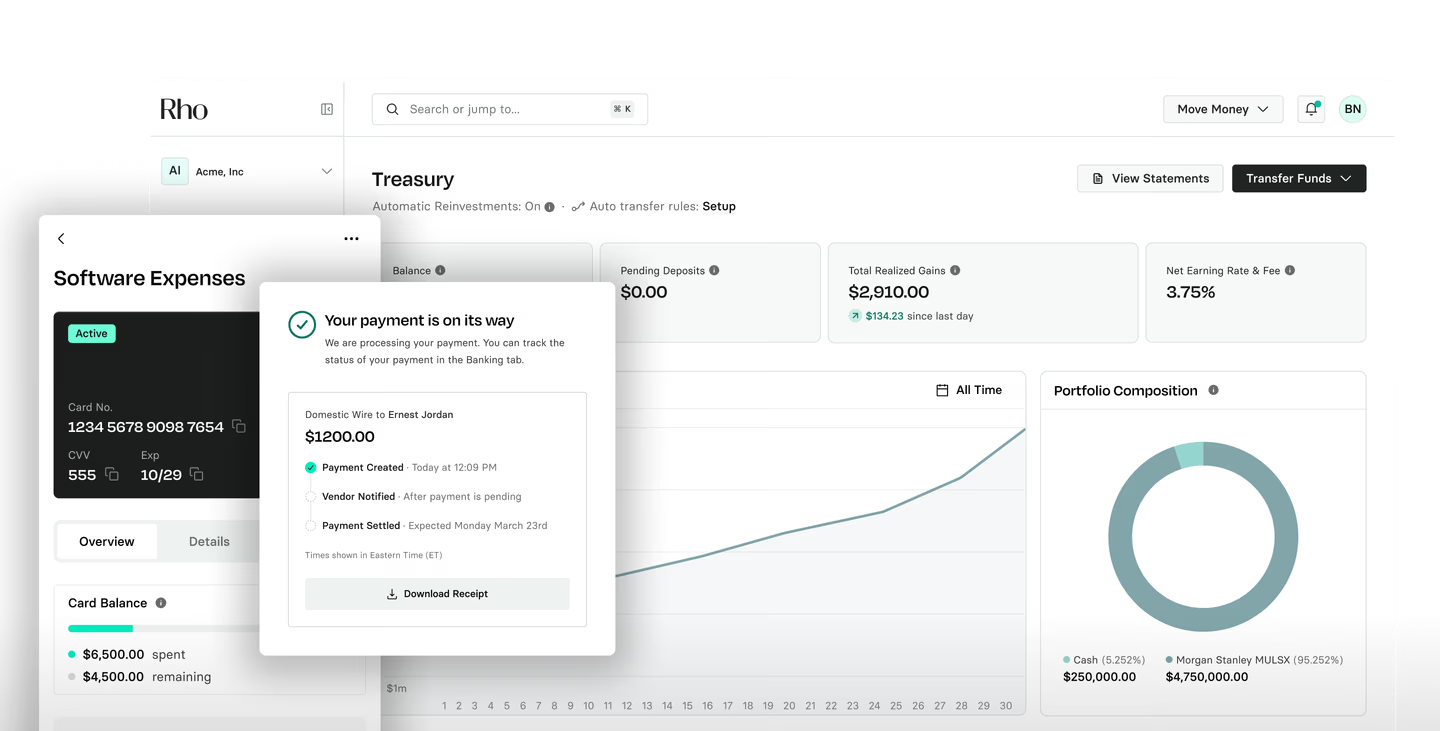

Get Ramp - $250 Bonus + 1.5% CashbackRho - Best for Finance Operations & AP Automation

Rho is a full finance platform disguised as a business bank. If your LLC is past the "just need a bank account" stage and ready for AP automation, vendor management, and treasury operations, Rho delivers. Plus, the $500 sign-up bonus is the highest in class.

| Metric | Details |

|---|---|

| Monthly Fee | $0 |

| Sign-Up Bonus | $500 (highest available) |

| Cashback | Variable on card spend |

| Setup Time | 1-2 days (requires revenue) |

| Best For | Growth-stage LLCs, AP/AR automation |

| Top Integrations | QuickBooks, Xero, NetSuite, Bill.com |

| FDIC Insurance | Up to $250k (Webster Bank) |

Why Rho Works

Rho targets established LLCs with real revenue and vendor relationships. You get corporate cards, AP automation, bill pay workflows, and treasury management in one platform. Multi-entity support is exceptional if you run multiple LLCs.

The vendor payment workflows alone save hours every month. Advanced reporting gives you real-time visibility into cash flow. And the treasury features help you maximize yields on idle cash.

The catch? Rho requires business revenue—they're not accepting brand-new LLCs. Approval takes 1-2 days versus instant. This is overkill if you just need simple banking.

Bottom Line: Best for established LLCs with revenue, vendor relationships, and finance operations that need automation. The $500 bonus and multi-entity support are unmatched.

Note About Rho Referral

To claim the $500 Rho sign-up bonus, contact us for a referral. We'll connect you directly to ensure you receive the full bonus.

Comparison by Use Case

Best for Brand New LLCs (Just Filed)

Top Pick: Mercury or Novo

You just filed your LLC and need an account fast. Mercury approves in ~10 minutes with just your EIN and Articles of Organization. Novo is equally fast and even simpler.

Best for Tech Startups & SaaS

Top Pick: Mercury

Mercury was built specifically for this use case. Investor update tools, cap table integrations, and a founder-friendly interface make it the default choice for tech startups.

Best for E-Commerce LLCs

Top Pick: Ramp or Relay

E-commerce businesses benefit from Ramp's cashback (1.5% on inventory, ads, software) or Relay's multiple accounts (separate inventory, operations, tax funds).

Best for No-Fee Banking

Top Pick: All of them (Mercury, Ramp, Rho, Relay, Novo)

Every bank we recommend charges $0/month. Compare that to traditional banks:

| Bank | Monthly Fee | Annual Cost |

|---|---|---|

| Chase Business Checking | $15-25 | $180-300 |

| Bank of America Business | $16-29.95 | $192-359 |

| Wells Fargo Business | $14-40 | $168-480 |

Savings over 5 years: $900-2,400 by avoiding traditional banks.

How to Open a Business Bank Account for Your LLC

What Documents You'll Need

- EIN (Employer Identification Number) - Get it free from IRS.gov, takes 5-10 minutes online

- Articles of Organization - Your LLC formation documents from your state

- Operating Agreement - Some banks require this, others don't

- Government-Issued ID - Driver's license or passport

- Business License (if applicable) - Some industries require state/local licenses

Step-by-Step Process

- Get Your EIN - Visit IRS.gov and apply online. Free, takes 5 minutes, you get it immediately.

- File Your LLC - File with your state. You'll receive your Articles of Organization.

- Create an Operating Agreement - Even if your state doesn't require it, create one.

- Choose Your Bank - Use this guide to pick the right fit.

- Apply Online - All the banks we recommend have online applications. Takes 10-30 minutes.

- Verify Your Identity - Upload your ID and documents. Most banks verify instantly.

- Fund Your Account - Initial deposit requirements vary ($0-100 typically).

- Get Your Debit Card - Physical cards arrive in 1-2 weeks. Virtual cards available immediately.

- Set Up Integrations - Connect Stripe, QuickBooks, payroll providers, etc.

Cash Back & Sign-Up Bonuses: Free Money for Your LLC

Traditional banks charge you fees. Modern banks pay you bonuses. The difference is wild.

Sign-Up Bonus Comparison

| Bank | Sign-Up Bonus | Requirements | Timeline |

|---|---|---|---|

| Rho | $500 | Open account, meet deposit/spend requirements | 60-90 days |

| Mercury | $250 | Open account via referral link | 30-60 days |

| Ramp | $250 | Open account, activate card | 30-60 days |

Strategic Approach: Stack Your Bonuses

Smart founders don't choose just one bank. They stack benefits:

- Open Mercury for primary banking, treasury, integrations → Get $250 bonus

- Open Ramp for corporate card/expense management → Get $250 bonus + ongoing 1.5% cashback

- Open Rho (if needed for AP automation) → Get $500 bonus

Total first-year bonuses: $1,000 + ongoing cashback from Ramp.

There's no limit to how many business bank accounts your LLC can have. Opening multiple accounts to maximize bonuses is perfectly legitimate (and smart).

FAQ: Business Bank Accounts for LLCs

Do I legally need a separate business bank account for my LLC?

Technically, it depends on your state. Practically: YES, absolutely.

Here's why:

- Maintain your corporate veil protection - If you commingle personal and business funds, you risk "piercing the corporate veil." This means a court could hold you personally liable for business debts.

- Easier bookkeeping and taxes - Separate accounts make it simple to track business income and expenses.

- Professional appearance - Accepting payments and issuing checks from "Smith LLC" looks more professional.

- Required for accepting payments - Payment processors like Stripe require business accounts for business entities.

- IRS audit protection - Clean separation between personal and business finances makes audits smoother.

Bottom line: Get a business bank account the day you file your LLC.

Can I use a personal bank account for my LLC?

You can, but you shouldn't. Using a personal account for LLC transactions risks:

| Risk | Why It Matters |

|---|---|

| Pierced corporate veil | Loss of liability protection |

| Tax complications | Harder to document business deductions |

| Payment processor violations | Stripe and PayPal require business accounts |

| Professional credibility | Less trust with vendors and customers |

Plus, business accounts are free now. Mercury, Ramp, Rho, Relay, and Novo all charge $0/month. There's no cost benefit to using a personal account anymore.

How much does it cost to open a business bank account for an LLC?

Fintech banks: $0

| Fintech Bank | Monthly Fee |

|---|---|

| Mercury | $0 |

| Ramp | $0 |

| Rho | $0 |

| Relay | $0 |

| Novo | $0 |

Traditional banks: $0-100 initial deposit, plus monthly fees

| Traditional Bank | Initial Deposit | Monthly Fee |

|---|---|---|

| Chase | $0 | $15-25 |

| Bank of America | $25-100 | $16-29.95 |

| Wells Fargo | Varies | $14-40 |

Bottom line: Opening an account is free everywhere. The difference is ongoing fees—fintech banks charge $0/month forever.

What credit score do I need for a business bank account?

Good news: Most fintech banks don't check personal credit for business checking accounts.

Mercury, Ramp, Rho, Relay, and Novo focus on:

| Focus Area | What They Evaluate |

|---|---|

| Business legitimacy | EIN, Articles of Organization |

| Business model | Industry, revenue, plans |

| Identity verification | Owner and entity verification |

Your personal credit score typically doesn't matter for basic business checking.

What About S-Corps?

Can S-Corps Use These Banks Too?

Yes! If your LLC elected S-Corp tax status, you can (and should) use these same business bank accounts.

Quick Explainer: What's an S-Corp Election?

An S-Corp isn't a business structure—it's a tax designation.

Key points:

| Point | What It Means |

|---|---|

| Still an LLC | No new formation documents required |

| IRS election | File Form 2553 for S-Corp tax treatment |

| Tax savings | Common for profitable LLCs to reduce self-employment taxes |

| Owner pay | Pay a reasonable salary, then take distributions |

Best Banks for LLC Taxed as S-Corp

1. Mercury - Gusto integration makes payroll seamless

2. Ramp - Expense categorization helps with S-Corp compliance

3. Rho - Advanced finance ops useful as S-Corp complexity grows

Bottom Line: If you're an LLC taxed as an S-Corp, use the same bank recommendations. Just prioritize those with strong payroll integrations (Mercury + Gusto is a popular combination).

Banks to Avoid (or When Traditional Banks Make Sense)

Traditional Banks You Can Skip for Most LLCs

For 90% of LLCs (especially tech, SaaS, e-commerce, service-based), fintech banks are objectively better.

Traditional banks made sense in 2015. In 2026, there's no compelling reason to pay $25/month for worse service, slower support, and limited integrations.

Legitimate Reasons to Choose a Traditional Bank

- Frequent cash deposits - If you're running a retail store, restaurant, or cash-heavy business

- SBA loans - If you need immediate access to SBA 7(a) or 504 loans

- International wire compliance - Some traditional banks have better international banking relationships

- In-person support - If you genuinely prefer face-to-face banking

The Hybrid Approach

Many smart founders use both:

Primary operating account: Mercury or Ramp (daily banking, integrations, $0 monthly fees)

Secondary traditional account: Chase or BoA (SBA loan access when needed, cash deposits if applicable)

Traditional Banks vs. Fintech Banks: Quick Comparison

When to Choose Fintech Banks

Choose fintech if:

| Situation | Why Fintech Wins |

|---|---|

| Tech, SaaS, e-commerce, or service business | Better integrations and workflows |

| Cost-sensitive operations | Saves $180-480/year in fees |

| Modern tool stack | Stripe, QuickBooks, and payroll sync |

| No need for physical branches | All-digital onboarding and support |

| Need automation | Virtual cards, rules, and controls |

The Reality in 2026

90% of LLCs should use fintech banks. The cost savings alone ($180-480/year) plus sign-up bonuses ($250-500) make the math obvious.

Best strategy: Primary account at Mercury/Ramp (daily operations), secondary account at Chase/BoA (if you need cash deposits or SBA loans).

Conclusion: Best Business Bank Accounts for Your LLC

TL;DR Recommendations

🏆 Best Overall: Mercury

Tech startups, SaaS, most LLCs. Clean banking, zero fees, $250 bonus, best integrations.

Get Mercury - $250 Bonus →

💳 Best for Expense Management: Ramp

Teams, high spend, expense automation. $250 bonus + 1.5% cashback on everything.

Get Ramp - $250 Bonus + 1.5% Cashback →

🏦 Best for Finance Ops: Rho

Established LLCs, AP automation, multi-entity. $500 bonus (highest available).

Contact Us for Rho Referral - $500 Bonus →

Action Steps

- Get your EIN (if you haven't already) - Visit IRS.gov, apply online, takes 5 minutes, free.

- Choose your bank based on your LLC type - Tech/SaaS → Mercury, Teams/expenses → Ramp, Established/finance ops → Rho

- Apply online (takes 10-30 minutes) - All applications are digital, no branch visits required.

- Set up integrations - Connect Stripe, QuickBooks, Gusto, etc.

- Start banking like a real business - Separate personal and business finances immediately.

Final Thought

Your business bank shouldn't cost you money or slow you down.

In 2026, there's zero reason to pay Chase $25/month for worse service when Mercury, Ramp, and Rho offer better products for free—and pay you up to $500 just to open an account.

Traditional banking made sense when it was the only option. It's not anymore.

Choose the bank that fits your LLC's needs, pocket the sign-up bonuses, and spend that $300/year you would've wasted on bank fees on literally anything else.

Affiliate Disclosure: This article contains affiliate links. If you open an account through our links, we may earn a commission at no cost to you. We only recommend banks we genuinely believe are the best options for LLCs.

Ready to Choose the Best Business Bank for Your LLC?

Join thousands of founders who've ditched traditional banks and saved hundreds in fees while earning cash back.